-

- Medium- to Long-term

Management Targets

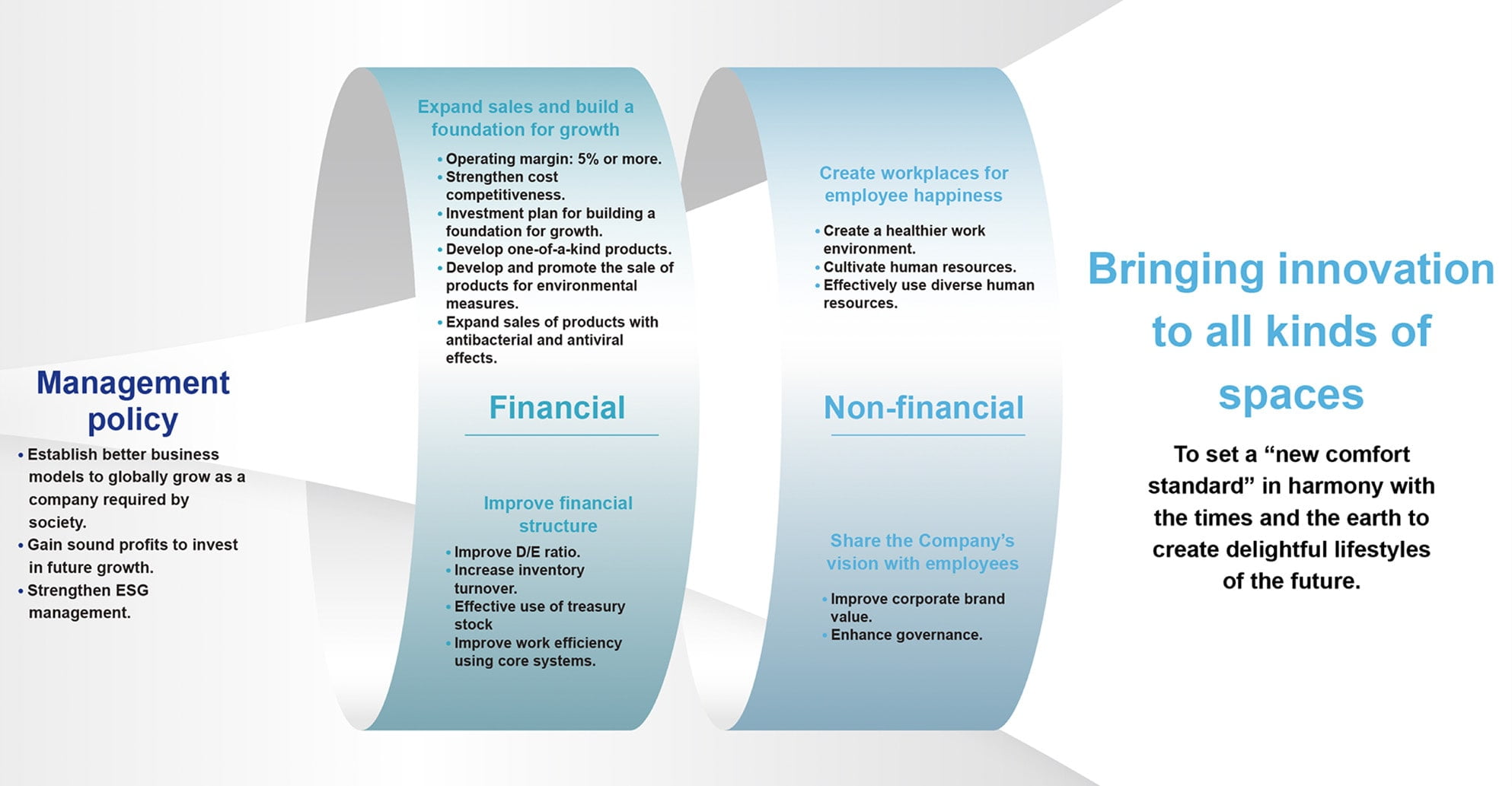

1. Overview of SUMINOE GROUP WAY

To ensure “change” for the future, we have formulated the Medium- to Long-term Management Targets.

This plan, called SGW (SUMINOE GROUP WAY), spans six years in two phases and is already under way.

2. Review of Medium- to Long-term Management Targets STEP I (2022-2024)

Medium- to Long-term Management Targets

Results and future tasks

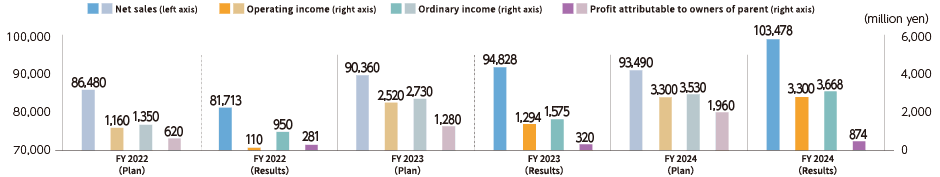

SGW STEP I plan and results

(Net sales and operating income achieved the plan)

| FY2024 plan | FY2024 results | |

|---|---|---|

| Net sales (million yen) | 93,490 | 103,478 |

| Operating income (million yen) |

3,300 | 3,300 |

| Operating margin (%) | 3.5 | 3.2 |

| ROE (%) | 6.6 | 2.9 |

| Capital investment (3-year total : million yen) |

10,000 | 10,953 |

Achievements

- Achieved profitability at the North and Central American base by restructuring the production systems of U.S. and Mexican subsidiaries (achieved profitability at all overseas bases for Automotive Textiles)

- Implemented appropriate price pass-through

- Increased recognition of the high environmental performance of ECOS® series, eco-friendly carpet tiles, under the horizontal recycling system

- Expanded the space design business

- Established a synthetic leather factory to sow the seeds for new development

- Worked to expand recognition as a global supplier in the North and Central American market, which resulted in receiving orders from foreign manufacturers

Future tasks

-

-

Automotive Textiles

- Strengthen capability for proposals through information sharing across businesses.

- Strengthen the management base and increase profits in North and Central America.

- Enhance proposals to foreign manufacturers and increase sales of new products.

-

-

Traffic Facilities

- Increase profits by optimizing and streamlining the production system.

- Expand sales by developing and increasing sales of functional products.

-

-

Interior Fittings

- Increase recognition of the SUMINOE brand.

- Implement strategies to recover sales of household products.

-

-

Functional Materials

- Expand from existing businesses and product categories.

- Effective use of human resources and production facilities at our Vietnam base.

Three-year Consolidated Income and Expenditure Plan・Results

| (million yen) | |||||||||

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| FY 2021 | FY 2022 | FY 2023 | FY 2024 | Comparison with FY 2021 *Comparison with FY 2024 results |

|||||

| Results | Plan | Results | Plan | Results | Plan | Results | (Amount) | (%) | |

| Net sales | 79,702 | 86,480 | 81,713 | 90,360 | 94,828 | 93,490 | 103,478 | +23,776 | +29.8% |

| Operating income | 1,049 | 1,160 | 110 | 2,520 | 1,294 | 3,300 | 3,300 | +2,251 | +214.5% |

| Operating margin | 1.3% | 1.3% | 0.1% | 2.8% | 1.4% | 3.5% | 3.2% | ||

| Ordinary income | 1,211 | 1,350 | 950 | 2,730 | 1,575 | 3,530 | 3,668 | +2,457 | +202.8% |

| Profit attributable to owners of parent |

409 | 620 | 281 | 1,280 | 320 | 1,960 | 874 | +465 | +113.6% |

| (million yen) | ||||||||

| Segment Plan・Results(2022-2024) | ||||||||

|---|---|---|---|---|---|---|---|---|

| FY 2021 | FY 2022 | FY 2023 | FY 2024 | |||||

| Results | Plan | Results | Plan | Results | Plan | Results | ||

| Interior Fittings | Net sales | 31,024 | 33,750 | 32,811 | 34,430 | 36,598 | 35,120 | 37,142 |

| Segment income | 579 | 400 | 911 | 450 | 977 | 520 | 946 | |

| Automotive Textiles and Traffic Facilities |

Net sales | 45,102 | 48,980 | 45,005 | 51,910 | 54,314 | 54,170 | 62,800 |

| Segment income | 2,102 | 2,800 | 1,127 | 3,590 | 2,230 | 4,170 | 4,427 | |

| Functional Materials | Net sales | 3,130 | 3,410 | 3,548 | 3,680 | 3,550 | 3,840 | 3,127 |

| Segment income | △87 | △140 | △192 | 150 | 90 | 190 | △66 | |

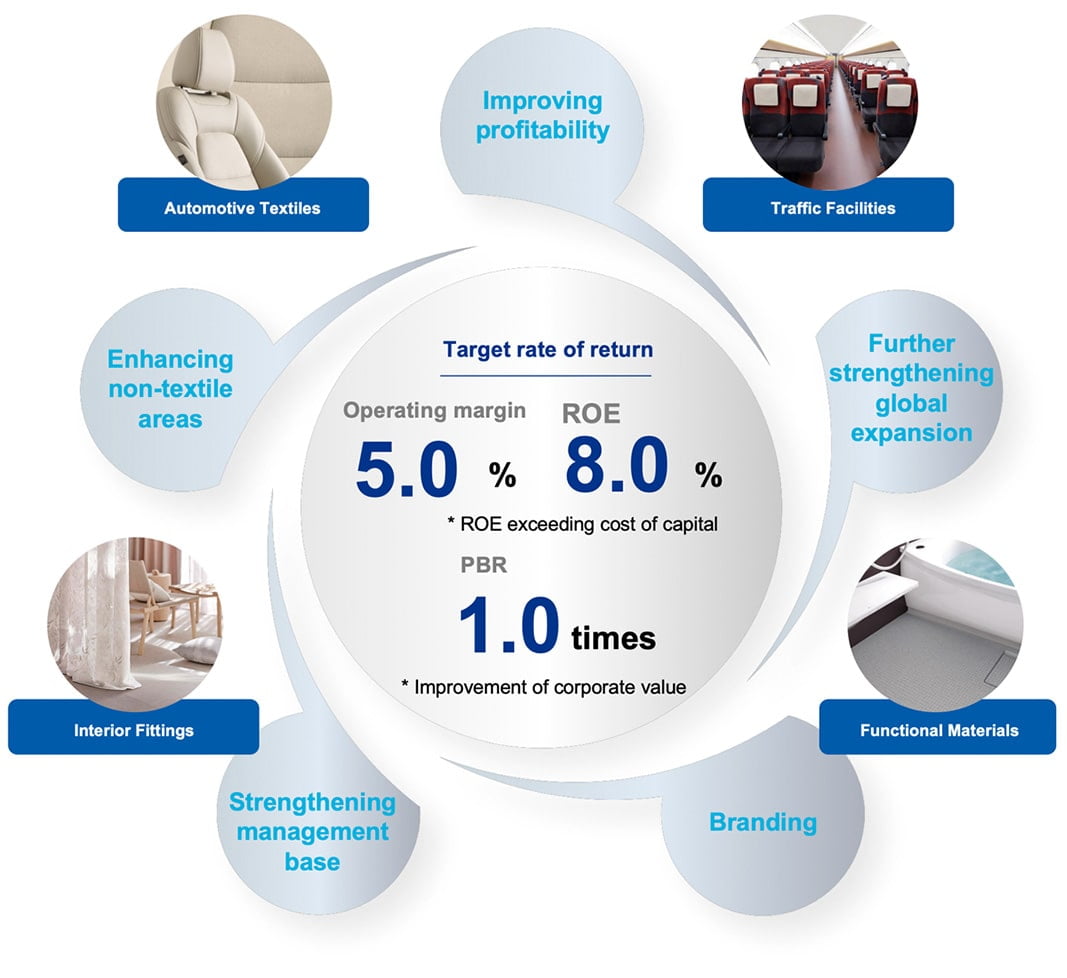

3. Policy of Medium-to Long-term Management Targets STEP Ⅱ(2025-2027)

Policy of STEP Ⅱ

Priority Themes

By pursuing five priority themes while steadily raising the level of our true capabilities, we aim to achieve our target rate of return by the fiscal year ending

May 31, 2027.

Policy of each Business

Policy of Automotive Textiles

-

Market trends

- Recovery from the deterioration of social and economic activities caused by the COVID-19 pandemic and shortage of semiconductors

- Population decline in the medium to long term

- Fluctuations of exchange rates, and soaring raw material prices and labor costs

- Expansion of new demand, such as practical application of MaaS, a next-generation transportation service

- Spread of the perspective of SDGs

Tasks

- Strengthen capability for proposals through information sharing across businesses.

- Strengthen the management base and increase profits in North and Central America.

- Enhance proposals to foreign manufacturers and increase sales of new products.

Policy

We will pave the way for improved profitability by updating our global strategy and advance investments for full-scale growth of our operations in North and Central America to increase our presence in overseas markets.

- Develop a proposal system for synthetic leather and further increase orders.

- Obtain new orders and expand sales for one-of-a-kind products, such as decorative fabric materials for car seats.

- Find new customers through technical and design presentations.

-

-

Accelerating global expansion

- By adding the Vietnam base to our current 11 overseas bases in six countries for the Automotive Textiles business, we will further strengthen our globally optimized supply system while working to increase the recognition of the SUMINOE brand overseas, which will lead to expanded sales for foreign manufacturers.

Enhancing non-textile areas

- The target of 10 billion yen in synthetic leather sales for the fiscal year ending May 31, 2027 was achieved in the fiscal year ended May 31, 2024. Going forward, with a synthetic leather factory in Mexico added as a new growth engine, we will work to strengthen our competitiveness by securing stable orders and optimizing/streamlining our production system.

Policy of Traffic Facilities

-

Market trends

- Recovery from the deterioration of social and economic activities caused by the COVID-19 pandemic and shortage of semiconductors

- Population decline in the medium to long term

- Fluctuations of exchange rates, and soaring raw material prices and labor costs

- Expansion of new demand, such as practical application of MaaS, a next-generation transportation service

- Spread of the perspective of SDGs

Tasks

- Increase profits by optimizing and streamlining the production system.

- Expand sales by developing and increasing sales of functional products.

Policy

As a market leader holding the top market share for over a century, we are committed to technological innovation while preserving traditional Japanese culture and techniques.

- Ensure an efficient and stable production system.

- Establish a safe and appropriate management system for technologies and know-how.

- Create new markets through collaboration with other businesses.

-

Policy of Interior Fittings

-

Market trends

- Changes in society due to external factors

- Decrease in new housing starts

- End of the COVID-19 pandemic

- Concentration of office and commercial facility construction in urban areas

- Weakened supply chains

Tasks

- Increase recognition of the SUMINOE brand.

- Implement strategies to recover sales of household products.

Policy

Taking pride in being an industry pioneer, we will work to enhance the profitability of existing businesses and create new value.

- Discover new demand and differentiate ourselves from other companies.

- Actively expand market into mid- to high-end zones.

- Strengthen sales by improving logistics efficiency in response to market changes.

- Create synergy with the space design business.

-

Policy of Functional Materials

-

Market trends

- Changes in consumer needs and purchasing trends due to climate change and lifestyle changes after the COVID-19 pandemic

- Fluctuations of exchange rates, and soaring raw material prices and labor costs

- Spread of the perspective of SDGs

Tasks

- Expand from existing businesses and product categories.

- Effective use of human resources and production facilities at our Vietnam base

Policy

As a source of technology to be deployed throughout the Company, we will work to develop new functions such as smart textiles and foster new growth businesses.

- Promote product development in response to social issues and market needs.

- Reinforce development in new areas for the next generation, such as smart textiles.

- Optimize operations at the Vietnam base through collaboration with other businesses.

- Develop applications of our unique materials and processing technologies and expand the scope of applications to other fields.

-

Policy for Technology Development

We will strengthen our research and technological capabilities, based on the enhancement of Group strengths and human resource development. We will “Bringing innovation to all kinds of spaces” to meet various needs that exist around the world.

-

Enhancement & integration

- Absorption processing technology

- Flame retardant technology

- Resin compounding technology

- Processing technology

- Analysis evaluation technology

NEW

Create new and intellectual property-linked core technologies. -

Enhancement of Group capabilities

- Create synergies by promoting communication among Group companies.

- Visualize intellectual property throughout the SUMINOE GROUP.

Cultivate human resources

- Promote sharing of technologies and quality through visualization of development cases and data.

- Reorganize testing operations, existing development operations, and new development operations, and train relevant employees.

- Create video manuals for measuring equipment to promote general use.

- Actively recruit overseas personnel and mid-career personnel.

Three-year Consolidated Income and Expenditure Plan・Results

| (million yen) | |||||||||

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| FY2024 | FY2025 | FY2025 | FY2026 | FY2026 | FY2027 | STEP I and STEP Ⅱ Comparison of final year |

|||

| Results | Plan | Results | Plan | Plan revision values |

Plan | (%) | (Amount) | ||

| Net sales | 103,478 | 105,300 | 104,791 | 106,000 | 105,000 | 109,000 | +5.3% | +5,521 | |

| Operating income | 3,300 | 3,300 | 3,001 | 4,200 | 3,100 | 5,000 | +51.5% | +1,699 | |

| Operating margin | 3.2% | 3.1% | 2.9% | 4.0% | 3.0% | 4.6% | |||

| Ordinary income | 3,668 | 3,400 | 2,514 | 4,200 | 3,350 | 5,000 | +36.3% | +1,331 | |

| Profit attributable to owners of parent |

874 | 1,500 | 669 | 2,100 | 1,500 | 2,600 | +197.3% | +1,725 | |

| Exchange rate (1 dollar) |

145.31yen | 144.00yen | 152.60yen | 131.00yen | 144.00yen | 125.00yen | |||

| (million yen) | |||||||||

| Net sales by base(2025-2027) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| FY2024 | FY2025 | FY2025 | FY2026 | FY2026 | FY2027 | STEP I and STEP Ⅱ Comparison of final year |

|||

| Results | Plan | Results | Plan | Plan revision values |

Plan | (%) | (Amount) | ||

| Net sales | 103,478 | 105,300 | 104,791 | 106,000 | 105,000 | 109,000 | +5.3% | +5,521 | |

| Japan | 67,793 | 68,900 | 69,507 | 71,100 | 69,400 | 73,000 | +7.7% | +5,207 | |

| North and Central America | 18,469 | 18,700 | 19,060 | 17,300 | 19,900 | 18,700 | +1.2% | +230 | |

| China | 8,098 | 8,000 | 7,285 | 7,800 | 6,300 | 7,900 | △2.5% | △198 | |

| Asia | 9,116 | 9,700 | 8,937 | 9,800 | 9,400 | 9,400 | +3.1% | +282 | |

| (million yen) | ||||||||||

| Breakdown by segment(2025-2027) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| FY2024 | FY2025 | FY2025 | FY2026 | FY2026 | FY2027 | STEP I and STEP Ⅱ Comparison of final year | ||||

| Results | Plan | Results | Plan | Plan revision values |

Plan | (%) | (Amount) | |||

| Automotive Textiles and Traffic Facilities | Net sales | 62,800 | 64,180 | 63,478 | 63,620 | 63,170 | 65,080 | +3.6% | +2,279 | |

| Segment income | 4,427 | 4,610 | 4,094 | 5,130 | 4,300 | 5,540 | +25.1% | +1,112 | ||

| Interior Fittings | Net sales | 37,142 | 38,040 | 38,264 | 38,790 | 38,740 | 40,030 | +7.8% | +2,887 | |

| Segment income | 946 | 1,000 | 1,023 | 1,130 | 1,150 | 1,360 | +43.7% | +413 | ||

| Functional Materials | Net sales | 3,127 | 2,650 | 2,566 | 3,090 | 2,620 | 3,390 | +8.4% | +262 | |

| Segment income | △66 | △180 | △124 | 90 | 20 | 170 | ― | +236 | ||

| Other | Net sales | 407 | 430 | 481 | 500 | 470 | 500 | +22.7% | +92 | |

| Segment income | 76 | 90 | 86 | 130 | 120 | 170 | +123.3% | +93 | ||

| Adjustment | Segment income | △2,083 | △2,220 | △2,077 | △2,280 | △2,490 | △2,240 | ― | △156 | |

| Total | Net sales | 103,478 | 105,300 | 104,791 | 106,000 | 105,000 | 109,000 | +5.3% | +5,521 | |

| Operating income | 3,300 | 3,300 | 3,001 | 4,200 | 3,100 | 5,000 | +51.5% | +1,699 | ||

Cost of Capital and Shareholder Returns

Action to Implement Management that is Conscious of Cost of Capital and Stock Price (Updated on July 11, 2025)

-

Analysis of current situation

- Cost of equity: 5 to 7%

Calculation method:

Calculated using CAPM, risk-free rate (approx. 1.0%) + beta value × market risk premium (approx. 6.0%)

The risk-free rate is based on domestic long-term interest rates, and the beta value is calculated in-house. - ROE: 2.1%(FY2025 result)

ROE continues to remain below cost of capital, and PBR continues to be below 1 times. - PBR: 0.5 times(FY2025 result)

- Cost of equity: 5 to 7%

-

Policy

- ROE: 8%(FY2027 target)

- ROIC: 8%(FY2027 target)

- PBR: 1.0 times(FY2027 target)

- WACC: 4%(FY2027 target)

- Dividend payout ratio: 38%

(From FY2025)

Enhancing IR activities

We are proactively engaged in constructive dialogue with shareholders and investors to achieve sustainable growth for the Group and improve our corporate value over the medium to long term, while also fostering market understanding.

In the fiscal year ending May 2025, in addition to holding financial results briefings twice a year, the President and CEO gave a company briefing for individual investors and the IR officer held individual meetings with institutional investors.

In addition, in order to promote constructive dialogue, we are also focusing on disseminating IR-related information, such as by using sponsored reports that provide information from a neutral standpoint and transcription services for financial results briefings held for institutional investors, in addition to timely disclosure.

Going forward, we will continue to communicate with shareholders and investors by increasing opportunities for comprehensive information disclosure, individual interviews, company information sessions, etc., and strive to ensure further understanding and transparency of our group.

-

Enhancing communication through IR activities

- Increase the number of briefings for individual and institutional investors.

- Upgrade disclosure materials.

- Support for disclosure in English

- Actively communicate information using websites and social media.

- Increase recognition through PR activities.

-

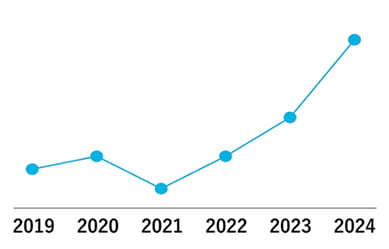

Opportunities for dialogue with shareholders and investors

- Financial results briefings for institutional investors and analysts

- Small meetings

- One-on-one meetings

-

- The number of sessions increased about three times that of 2019.

-

- Briefings for individual investors

Returns to shareholders

Our company has established a shareholder return policy of "stable shareholder return" and "continuously expanding returns." While working to strengthen our financial position and enhance the internal reserves necessary for active business development, we have set a minimum annual dividend of 35 yen, except in cases where business performance declines significantly due to a sudden deterioration in the business environment. We have raised our dividend payout ratio from 33% to 38%, and aim to achieve an annual dividend of 70 yen in the fiscal year ending May 2027 by achieving consolidated sales of 100 billion yen or more and an operating margin of 5% or more.

Policy on shareholder returns

-

Stable shareholder returns

- Dividends are basically paid twice a year, as interim and year-end dividends.

- Except in unforeseen circumstances, such as a sudden deterioration in the business environment, dividends will be maintained at a minimum of 70 yen per share.

-

Continuous expansion of returns

- The payout ratio will be raised from 33% to 38%. We aim at an annual dividend of 140 yen for FY2027.

- We will continue to offer a shareholder special benefit plan that includes our own products.

※The Company conducted a 2-for-1 stock split of its common stock with an effective date of March 1, 2025. The figures shown above are calcurated assuming that the stock split was conducted.

4. Materiality

We identified our materiality based on the issues in the Medium- to Long-term Management Targets, which were derived from international standards regarding social responsibilities and sustainability, and through interviews with and surveys on stakeholders both inside and outside the Company.

| Field | Materiality(Key Issues) | Themes | |

|---|---|---|---|

| Value creation/ Revenue opportunities |

Improve the social value of the SUMINOE brand through innovation. Provision of valuable products and services |

Pursuit of design, texture and functionality to provide a comfortable environment in all kinds of spaces | |

| Inheritance and development of traditions and techniques | |||

| Development, manufacture and sales of environmentally friendly products | |||

| E (Environment) |

Under our fundamental development philosophy "KKR+A(Kenko [Health], Kankyo [Environment], Recycling and Amenity)" and "Environmental Declarallon," we will promote the concept of "harmony with the earth." Preservation of the global environment |

Response to climate change issues | |

| Energy-saving and highly efficient production | |||

| Efficient use of resources/reduction of waste | |||

| Reinforcement of the environmental management system | |||

| Biodiversity conservation | |||

| S (Society) |

Create an organizational culture where diverse human resources can work width motivation and thrive in a safe, secure environment. Human resources strategy |

Respect for human rights and diversity & inclusion | |

| Human resource development and utilization | |||

| Penetration of the Group's philosophy, and creation of rewarding working environment | |||

| Occupational safety and health/Health and productivity management | |||

| Work style reform/work-life balance | |||

| Produce and sell quality products and contribute to the improvement of society. Product safety and quality |

Product safety and quality management | ||

| Work width suppliers to help build a sustainable society. Sustainable procurement |

Supply chain management | ||

| G (Governance) |

Build a foundation of corporate trust by ensuring transparency. Enhance governance. |

Improvement of corporate governance | |

| Thorough compliance and prevention of unfair competition and corruption | |||

| Reinforcement of risk management and promotion of business continuity planning (BCP) | |||

| Reinforcement of information security | |||

| Appropriate information disclosure and stakeholder engagement | |||

“Notice Regarding Formulation of the Medium-to Long-term Management Targets for the Latter Three-Year” announced on July 12, 2024.

“Notice Regarding Formulation of Medium- to Long-term Management Targets” announced on July 13, 2021.

Note on forward-looking statements

The forward-looking statements in this document regarding the Company’s future plans, strategies, etc. are based on a reasonable judgment that is predictable at this point, and actual results may differ due to various factors in the future.